Deduction Management System Software to Streamline Disputes

Deduction Management

Deduction Management is the procedure of tracking the deductions made by clients using receivables. Additionally, it interfaces with general ledger, billing, promotion, and order management programs.

Deduction Management System | Deduction Management Software

Benefits:

- You can enter your consumer promos if you utilize a promotion management system. You can also access Deduction Management to view the status of promotions.

- In your order management system, you produce sales orders. You can examine sales order information straight. To view the data if you utilize a third-party system, you have to develop an interface.

- Your billing system generates invoices, which you then connect to receivables. You can view billing details straight. To view the data if you utilize a third-party system, you must develop an interface to tables.

- You can manually submit the client payment into Receivables using an expedited or regular deposit or electronically utilizing the Payment Loader process (AR PAYLOAD).

- Using the Payment Worksheet or Payment Predictor (AR PREDICT), you apply the payment, close the original invoice, and generate the deduction items.

- You connect your billing system’s credit and debit memos to function as deduction authorizations. In a marketing application, these credit and debit memos might be used to represent trade payments.

- To create items, you must extract the deductions and offset items. Items whose entry type and reason match a deduction extract type and reason are extracted by the Extract Deductions process (DM EXTRACT).

- You look into the deduction to see how Deduction Management software can handle it.

- By using the Automatic Deduction Resolution process (DM RESOLVER) or the Resolution Worksheet, you can automatically resolve the deductions. Deductions can be eliminated by writing them off or matching them with a credit memo.

- People can send an item back to Receivables if they can’t resolve a deduction or offset item in Deduction Management software.

- You interface the accounting entries to your General Ledger application after you have resolved the deduction.

Deduction Management Software Process

Imagine that you are eager to get your paycheck on the last day of the month, but the bonus you were expecting never materialized for some reason. It is, to put it mildly, a complete bummer. Similar to this, every business encounter circumstances where it receives less money from its clients than anticipated for unforeseen reasons. The unpaid amount is regarded as a deduction. This deduction could occur for a number of reasons, including:

- Damaged Goods

- Shipment Shortage

- Billing Errors

To ascertain the purpose and legality of the deduction taken, businesses must evaluate their deductions management. But first, let’s define a deductions management procedure before we delve into the specifics.

The procedure used by the deductions teams to deal with deductions is known as a deductions management process. Depending on the size, preferences, and software abilities of the organization, this may differ from company to company. Your business might see an improvement in recovery rates and a reduction in the amount of time needed to settle disputes with an effective deduction management strategy. But how effective do you think your manual, traditional deductions management procedure really is? Or do you need to use artificial intelligence and technology to scale it up?

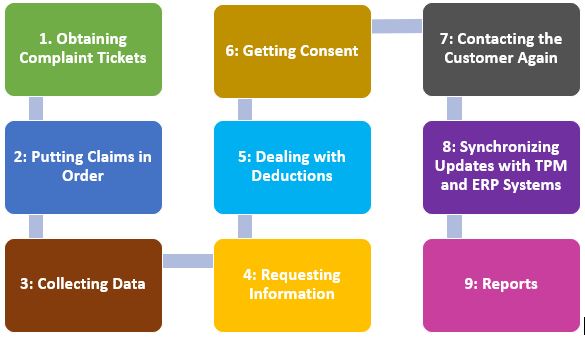

The manual, more traditional method of managing deductions has many drawbacks, particularly as businesses expand. Let’s take a closer look at each stage.

Step 1: Obtaining Complaint Tickets

A dispute ticket from the client or a deduction claim from the accounts department are sent to an analyst.

Step 2: Putting Claims in Order

After that, the analyst ranks the assertions according to importance. Usually, this is done based on the value of the deduction.

Step 3: Collecting Data

The analyst begins to gather supporting data and locates the invoice’s source once the deduction or short payment has been found. The analyst can better determine the appropriate stakeholders for the invoice by locating the source. The analyst manually collects all the invoice-related papers, including the tax receipt, Proof of Delivery (PoD), order invoice, Bill of Lading (BoL), sales invoice, and other order-related documents.

Step 4: Requesting Information

The deductions analyst manually contacts the stakeholders and internal teams to collect the necessary data if any information is missing or wrong.

Step 5: Dealing with Deductions

After compiling the materials, the analyst compares various records with the claims document and attempts to determine whether the deduction was legitimate.

Step 6: Getting Consent

The deductions analyst may need to follow up with their superiors to seek permission if the claim meets specific conditions. This leads to more back and forth and delays the decision even more.

Step 7: Contacting the Customer Again

If the claimed deduction is invalid, the analyst manually notifies the client in a correspondence of the claim request’s rejection. The analyst interacts with the customer and issues either a debit memo or credit memo a for the client’s future usage if the deduction claim is legitimate.

Step 8: Synchronizing Updates with TPM and ERP Systems

Following the claim’s declaration of validity, the analyst notifies the accounts department of its validity and requests that they adjust the invoice in the ERP and issue a credit or debit memo as necessary. The client’s account status is then changed to closed.

Step 9: Reports

Reports are manually created, typically in Excel, to assist managers and executives in understanding how the deducting operations are doing. Due to the lack of real-time data, producing these reports takes a lot of time. Now that we are aware of the difficulties that the conventional deduction management process faces, let’s explore how artificial intelligence (AI) might be used by businesses to automate these procedures and enable the deduction management team to concentrate on the early identification and settlement of disputes.

Different Deduction Management Software (accounts receivable deductions management)

-

Highradius AI-Based Deduction Management Software

Accounts receivable disputes can seriously hurt organizations because they have an impact on their cash flow. Ineffective dispute management in accounts receivables or unresolved disputes could have a negative impact on your company’s bottom line. Therefore, highradius AI-based deduction management software ensuring prompt dispute resolution while maintaining a great customer experience may be a delicate balance to strike, but it is essential in the modern world.

-

Carixa Deduction Management Software

There is a good chance that your retailer and distributor deductions are costing you too much money. Utilize Carixa’s deduction management software to keep chargebacks and deductions under control. Carixa verifies information and provides insight to stop deductions in the future. With Carixa SaaS, limit write-offs to lower revenue dilution and increase profits.

-

Cashbook Deductions Management Software

The deducting procedures result in a loss of revenue and earnings. Both big and small businesses make deduction claims with codes and justifications that are specific to the customer. Deduction management can be tailored to any bank file or remittance type. Deductions can be routed for quick inspection and approval. Regardless of ERP, generate justification and deduction codes straight from remittance data. Automate the deductions procedure to begin recouping more money with Cashbook’s deductions management software.

-

Cforia Deductions and Disputes Management

The Deduction & Dispute Management software from Cforia.autonomy gives your business the visibility and responsibility it needs to monitor deductions and disputes. It then makes it easier for your A/R Department to work with other teams and customers to identify their causes.